How The Hybrid Annuity Model Came To Be

Road projects/Highways projects in India are awarded based on the Public Private Partnerships (PPP) model. As a part of this operating model, the highway contracts are awarded under one of the following three models – Build-Operate- Transfer (BOT)-Annuity, BOT-Toll, and EPC (Engineering, Procurement and Construction) contract. The BOT-Toll and BOT-Annuity were the commonly adopted models in the past years.

Problem Areas

Since the new Government took over in 2014, there were questions raised on the number of pending roadways and highway projects. As the number of road projects increased, results showed that certain road projects did not have the adequate traffic that paid toll for using the roads.

This automatically demanded the contractors to look out for Government support which was achieved through the Viability Gap Funding (VGF) (about 20-40%).

In other areas, there were some roads connecting major cities that had the capability to generate more adequate toll than what was required. In these cases, the Government funding was not necessary and contractors paid money to the Government to get the project.

Unfortunately, things went haywire and the contractors started facing the heat, almost to the extent that they returned the concession back to the Government. In rural areas, the Government decided to offer a 100% support through annuity payment over the concession period and offered a contract to the contractor bidding for the lowest annuity. Later, upon realization, the government decided to discontinue this option as it created a full-time overhead and made it open only for special cases.

The Hybrid Annuity Model – Fundamentals

With the confusion revolving around the existing models and lack of response from builders for new contracts, the Government decided to look for an alternative solution. Finally, a revision to the then existing Model Concession Agreement (MCA) was agreed to address the concerns faced by the stakeholders. This new/revised MCA is called the Hybrid Annuity Model (HAM).

More on The Brief: Here’s Why Kia Motors Producing 3 Lakh Cars In India Is A Smart Move

Launched in 2016, HAM is a type of the PPP model and a mix of the EPC and BOT Annuity models. As part of the HAM model, Government bears 40% of the project cost (fixed cost) in the first five years through annual payments (referred to as Annuity). The balance 60% project cost will be made based on the value of the assets that are created and the performance of the builder (variable cost). Therefore, the Government only pays for 40% of the project cost while the builder has to arrange the funds for remaining 60% in the form of loans or equity.

How The Hybrid Annuity Model Is Different From BOT And Other Models?

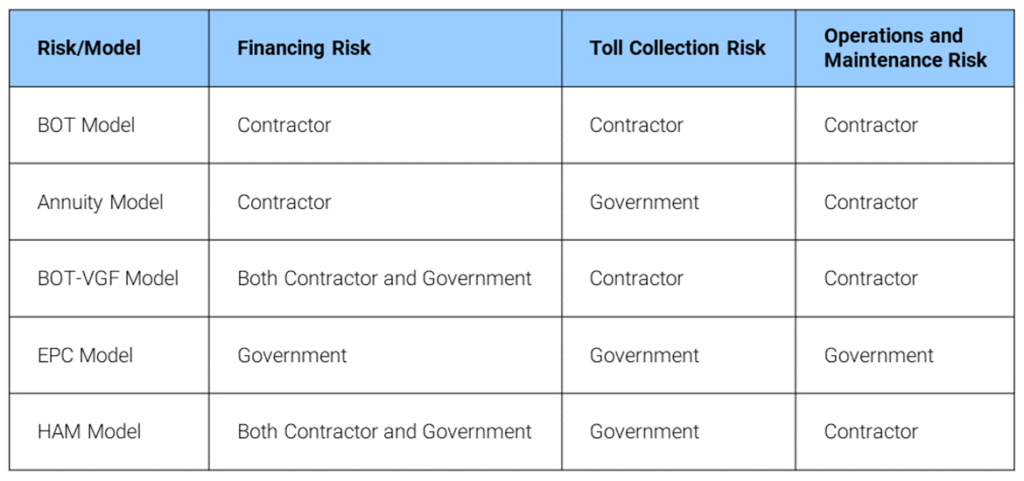

With the previous models (BOT Model), majority of the risks (financing, toll collection risk, and operations and maintenance risk) was with the building contractor. Here’s how HAM reduces the risk when compared to the other business models –

Success Of The Hybrid Annuity Model

Since the introduction in January 2016, the HAM model has been seeing increased success rates. In 2016-17, the National Highways Authority of India (NHAI) awarded HAM projects for about 2,434 km at a budget of Rs. 36,300 crore. In 2017-18, the NHAI awarded HAM projects around 3,396 km for about Rs. 76,500 crore. This shift from BOT to HAM model is definitely creating a positive impact in terms of the pace of construction and increase in the number of projects.

Is Hybrid Annuity Model A Long Term Solution?

The answer is a definite ‘YES’!

Why do we say so? Here are a few reasons:

- The major benefits of implementing HAM is mainly two fold – one, HAM minimizes a lot of risks for both the contractors as well as the government itself. Second, contractors can bid for projects keeping in mind both the Capital Expenditure (CAPEX) and Operational Expenditure (OPEX) involved in taking up the project.

- As Moody’s Investors Service says “Private investment in highway projects had been declining in recent years, amid issues such as slow project approvals and cost overruns, but the Indian government’s introduction of the hybrid annuity model (HAM) in 2016— as a variation of PPPs—has triggered new investment inflows.”

- With the HAM model, the government will take responsibility of the toll collection, while the Highway Authority will collect the toll charges and refund it as installments to the government over a period of 10 years (in 20 installments).

- The contractor is freed up from spending his 100% cash reserves for the project since the government also shares the financial risk. On the other hand, when compared to EPC projects, the HAM model will also ease the cash flow pressure on NHAI.

- The HAM model will improve the credit profiles of infrastructure and contract developers. This gives them the confidence to participate in more PPP projects.

- The introduction of HAM project will not put a complete end to BOT model, especially the BOT (toll) model. The government can choose to implement the HAM model for projects that are stuck due to cash problems or where other models are not applicable.

Summarizing

Infrastructure plays a major role in the growth of the economy of a country. With India ranking as the second largest road network in the world, it’s crucial for initiatives such as Hybrid Annuity Model to kick off to boost the infrastructure and make life easier for the people. HAM is a win-win for both the government as well as the private contractors as it speeds up the construction of highways across the country without causing much financial risks for the private players.

About The Author